The Ultimate Guide to Pocket Option Indicators

22. 9. 2025, 8:14

The Ultimate Guide to Pocket Option Indicators

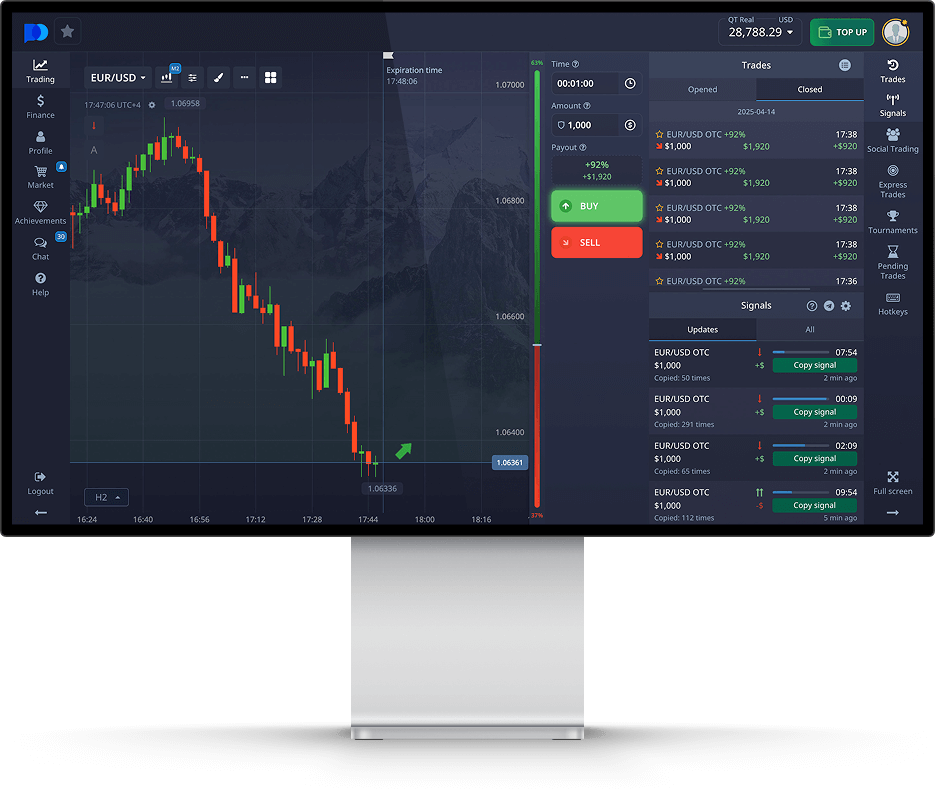

Trading on platforms like Pocket Option requires more than just intuition; it demands a solid understanding of the tools available to enhance your trading strategy. One of the most crucial aspects of trading is making informed decisions, and that’s where indicators come into play. In this article, we will delve deep into the world of Pocket Option indicators, discussing their significance, how to utilize them effectively, and the benefits they offer to traders. For those looking to start trading, it’s worth noting that you can explore options pocket option indicators без инвестиций Poket Option to minimize risks.

Understanding Pocket Option Indicators

Indicators are mathematical calculations that traders use to analyze historical price movements and predict future price action. In the context of Pocket Option, indicators serve as valuable tools that help in identifying market trends, determining potential entry and exit points, and providing signals for various trading strategies. Whether you are a novice or an experienced trader, incorporating indicators into your trading plan can provide you with a significant edge.

Types of Pocket Option Indicators

There are several types of indicators traders can use on Pocket Option, each serving a different purpose. The most common categories include:

1. Trend Indicators

Trend indicators are designed to identify the direction of market movement. Some popular trend indicators used in Pocket Option include:

- Moving Averages (MA): Averages of price over a specific period, helping to smooth out price action.

- Average Directional Index (ADX): A trend strength indicator that indicates if the market is trending or ranging.

2. Momentum Indicators

Momentum indicators help traders measure the speed of price changes. They can signal potential reversals when divergence occurs. Key momentum indicators include:

- Relative Strength Index (RSI): A widely-used oscillator that measures the speed and change of price movements.

- Stochastic Oscillator: Compares a particular closing price to a range of prices over a specific period.

3. Volatility Indicators

Volatility indicators measure the degree of variation in trading prices. High volatility indicates potential price swings, making these indicators useful for short-term traders. Notable volatility indicators include:

- Bollinger Bands: A volatility indicator that consists of a middle band and two outer bands that indicate standard deviations away from the middle band.

- Average True Range (ATR): Measures market volatility and can indicate potential entry points based on price fluctuations.

How to Use Indicators on Pocket Option

Using indicators effectively involves understanding how to apply them in different market conditions and aligning them with your trading strategy. Here’s how to utilize them:

- Choose the Right Indicators: Depending on your trading style—whether day trading, scalping, or swing trading—you should choose indicators that align with your objectives.

- Backtest Strategies: Always backtest your strategies with historical data to understand how the chosen indicators perform in various market conditions.

- Combine Indicators: Use a combination of indicators to confirm signals. For example, using both a trend indicator and a momentum indicator can provide a more comprehensive view of market conditions.

- Set Alerts: Set up alerts in Pocket Option when indicators reach certain thresholds to help you respond swiftly to potential trading opportunities.

Benefits of Using Indicators

The primary benefits of using Pocket Option indicators include:

- Enhanced Decision-Making: Indicators provide quantitative data that can help traders make more informed decisions rather than relying solely on emotions.

- Trend Identification: They help to identify trends early, allowing traders to capitalize on movement direction.

- Better Entry/Exit Points: Indicators can signal when to enter or exit trades, thus improving potential profit margins.

- Risk Management: Using indicators allows traders to set stop-loss and take-profit levels based on market conditions, enhancing risk management.

Conclusion

Integrating indicators into your Pocket Option trading can significantly boost your chances of success. By understanding how various indicators work and how to apply them effectively, you can make informed trading decisions that align with your overall strategy. Always remember to keep learning and refining your approach as the market evolves. Happy trading!

Fatal error: Uncaught Error: Call to undefined function the_field() in /srv/app/wp-content/themes/grm/single.php:34 Stack trace: #0 /srv/app/wp-includes/template-loader.php(106): include() #1 /srv/app/wp-blog-header.php(19): require_once('/srv/app/wp-inc...') #2 /srv/app/index.php(17): require('/srv/app/wp-blo...') #3 {main} thrown in /srv/app/wp-content/themes/grm/single.php on line 34